Building business credit is a foundational step for every new entrepreneur aiming to lay a solid financial groundwork for their enterprise. Like constructing a skyscraper, it requires initial quick wins—such as obtaining an employer identification number (EIN)—and long-term dedication, like maintaining a consistent payment history. In the competitive world of commerce, your business credit is more than just a number; it reflects your company’s reliability and financial health. This blog post will guide you through the ten critical steps to establish, nurture, and grow your business credit, paving the way for a prosperous and sustainable business future. From incorporation to intelligent credit management, each step is integral to the robust structure of your business’s credit reputation.

Table of Contents

Importance of Building Business Credit

Building business credit is critical for any company, particularly in sectors where contract negotiations are commonplace, such as professional services.

A solid business credit profile can profoundly impact a company’s financial flexibility. It signals lenders, suppliers, and potential partners that your business is trustworthy and creditworthy.

A good business credit score can lead to better financing terms and more favorable credit limits and can even influence the premiums your business might pay for insurance policies.

Benefits of Establishing a Strong Business Credit

Establishing a solid business credit profile can provide many benefits for a company.

Here are some key advantages that companies can enjoy when they focus on building solid business credit:

- Easier Access to Capital

- Lenders often assess a company’s creditworthiness based on its business credit.

- A strong credit history can lead to approval for loans and credit at more favorable terms.

- Businesses with good credit are more likely to receive more extensive lines of credit.

- Better Financing Terms

- Companies with good credit can negotiate lower interest rates.

- They may also qualify for more advantageous repayment terms.

- Savings on interest can be significant, reducing overall financing costs.

- Separation of Personal and Business Credit

- A clear separation of personal and business finances limits personal liability.

- In the case of a legal issue or business debt, personal assets are more protected.

- Business credit strengthens the financial independence of the company.

- Enhanced Company Reputation

- Good credit can improve relationships with suppliers and vendors.

- It demonstrates the company’s reliability and financial stability.

- A strong credit rating can be a deciding factor in contracts or bids.

- Increased Borrowing Power

- A solid credit history creates confidence in the company’s ability to repay debts.

- Over time, the business can borrow more.

- More credit options become available, supporting future expansion and contingencies.

- Lower Insurance Premiums

- Insurance companies frequently consider credit scores when setting insurance rates.

- Businesses with higher credit ratings may pay less for insurance coverage.

- This can lead to significant cost savings across various insurance policies.

- Better Cash Flow Management

- With good credit, businesses may not be required to prepay for goods or services.

- This arrangement helps maintain better cash flow for operations.

- It also allows companies to leverage trade credit as an interest-free short-term financing option.

- Emergency Preparedness

- Companies with established credit have more options during economic downturns.

- They can access credit resources to manage through unanticipated events or crises.

- The ability to obtain funding quickly can be crucial for survival during tough times.

- Attractive to Potential Investors

- Investors often consider a business’s credit history as part of their due diligence.

- Strong business credit increases the attractiveness to potential investors and partners.

- It suggests that the business is well-managed and a lower-risk investment.

- Business Growth and Expansion

- A strong credit profile supports investment in new projects and expansion.

- It helps secure funds for marketing, new staff, or more extensive facilities.

- Access to various forms of credit can fuel the overall growth of the business.

Companies can reap these benefits by investing time and effort into establishing solid business credit, contributing to long-term stability and success.

Read More About Upgrade Your Business Operations with a Virtual PO Box

Steps [1-3]: Foundation for Building Business Credit

1- Registering Your Business

The critical first step in building business credit is legally registering the business.

This definitive move separates the entity from personal dealings and sets the stage for creating an independent credit profile.

Registration not only lends legitimacy but also protects the owner personally against liabilities the business might incur.

In this way, it sets the cornerstone for a structure on which a trustworthy business credit standing can be developed, marking the business as a separate entity in the eyes of creditors and regulatory bodies.

2- Obtaining an EIN

Following the legal registration, the next step is obtaining an Employer Identification Number (EIN).

The IRS assigns this nine-digit number, which is comparable to a business’s social security number. It is essential for tax purposes but also plays a significant role in establishing business credit.

An EIN enables the business to compensate employees, establish a business bank account, and form a separate credit history from the owner’s credit.

It is the second pillar in erecting a solid framework for a business credit report that reflects the financial responsibility of the enterprise.

3- Opening a Business Bank Account

Opening a dedicated business banking account is essential to establishing a business credit foundation.

This account separates business finances from personal ones and is another factor that bolsters the business’s credibility.

Consistently using a business banking account for all transactions assists in demonstrating the business’s cash flow and financial health.

Lenders and credit agencies closely scrutinize these accounts when assessing creditworthiness.

Moreover, a business bank account is a reservoir from which credit data springs, weaving a financial tapestry credit bureaus use to calculate business credit scores.

Therefore, maintaining a professional bank account with diligent fiscal practice is another step toward building commendable business credit.

Steps [4-6]: Key Actions to Establish Business Credit

4- Separating Personal and Business Finances

Separating personal and business finances is a decisive step in securing sound business credit. This clear division helps reduce confusion regarding accounting and tax preparation.

It also minimizes the potential risks to personal assets should the business face financial difficulties.

Maintaining this separation instills a level of professionalism and transparency that credit bureaus and financial institutions look favorably upon.

By establishing clear boundaries between personal and business finances, entrepreneurs lay the groundwork for a credit profile that accurately reflects the business’s financial practices and risk level.

5- Opening a Credit File

Opening a credit file with the central business credit bureaus is critical to further advancing the foundation of business credit.

This step ensures that business credit activities are appropriately tracked and accurately reported.

Creating a credit file usually requires acquiring a D-U-N-S Number from Dun & Bradstreet, the leading business credit reporting agency.

Establishing this file enables credit transactions to be recorded, contributing to the business’s credit history.

This credit history is crucial as it informs lenders and suppliers about the business’s creditworthiness and fiscal responsibility, influencing their decision to extend credit.

6- Acquiring a Business Credit Card

Acquiring a business credit card is an essential step in establishing business credit. Utilizing a business credit card responsibly can illustrate the company’s ability to manage credit effectively.

The activity associated with the business credit card, including timely payments and keeping balances within credit limits, helps build a positive credit history.

It’s also instrumental in increasing the business’s credit score, providing reports of credit card issues to the credit bureaus.

By consistently demonstrating fiscal discipline through a business credit card, businesses can enhance their creditworthiness, paving the way for more favorable credit terms in the future.

Steps [7-9]: Strategies for Building Business Credit

7- Borrowing from Lenders

Businesses must establish their creditworthiness by possessing credit and actively using and repaying it.

Borrowing from lenders and institutions that report to the central business credit bureaus can beneficially impact a business’s credit history.

When taking out small loans or business lines of credit, companies demonstrate their ability to handle financial commitments.

Strategic borrowing, followed by prompt repayment, strengthens a business’s credit profile and positions it as a low-risk borrower, potentially leading to more advantageous loan terms.

8- Opening Vendor Lines of Credit

An often-overlooked strategy in building business credit is establishing trade lines with vendors.

By setting up accounts with suppliers that offer payment terms, businesses can make purchases on credit and defer payment to a later date.

This extension of credit further enhances a business’s credit history, especially when these vendors report to credit bureaus.

Engaging with vendors who offer “net-30” or “net-60” day terms is essential, as this gives the business a chance to showcase their punctuality in clearing debts, thus positively reinforcing their credit standing.

9- Making Timely Payments and Managing Credit Responsibly

The cornerstone of a strong business credit profile is the consistent practice of making timely payments.

Delinquent payments can significantly harm a business’s credit score, so always paying creditors on time or early, if possible, is crucial.

Furthermore, responsible credit management involves keeping credit utilization low.

By using a modest percentage of the available credit and avoiding maxing out credit lines, businesses signal to credit bureaus and lenders that they exercise prudent financial control.

Over time, such habits contribute significantly to establishing a firm’s creditworthiness, making it more appealing to future creditors and financial partners.

Step [10]

10- Monitoring Your Business Credit Score

A crucial step in building a robust business credit profile is regularly monitoring your credit score.

This helps keep track of your business’s financial health and alerts you to any inaccuracies or fraudulent activities that may affect your credit standing.

Proactive credit monitoring allows businesses to rectify issues quickly and maintain a positive credit history.

Frequent checks on credit reports from top business credit bureaus will help keep credit information up to date, allowing business owners to resolve any discrepancies quickly.

Keeping a watchful eye on the business credit score helps make more informed financial decisions that can lead to better credit opportunities and lower interest rates on loans.

Celebrating Milestones and Future Growth Opportunities

As a business works through the initial steps of establishing and building credit, achieving each milestone deserves recognition.

These achievements symbolize the business’s commitment to financial credibility and open doors to various growth opportunities.

A strong business credit score can help secure larger loans, better supplier payment terms, and influence potential partnerships and contracts.

Moreover, as the enterprise grows, the benefits of having established business credit can become even more pronounced.

It provides a foundation for expansion strategies such as mergers, acquisitions, or even going public, should the business owners choose that route. Building business credit is continuous and evolves with the company’s growth.

By following these steps and managing credit wisely, businesses can ensure they have the financial reputation and resources to seize future growth opportunities and thrive in their respective markets.

Achieve Financial Success: Steps to Building Business Credit Effectively

Building business credit is a crucial step for any company’s financial success. It allows businesses to access better financing options, negotiate favorable terms with suppliers, and establish credibility in the market.

Here is a streamlined listicle detailing the steps a business can take to build credit effectively:

- Establish Your Business Entity:

- You can formalize your business by registering it as a legal entity, such as an LLC or corporation.

- Get an EIN issued by the federal government.

- Could you set up a specialized business banking account?

- Register with Business Credit Bureaus:

- Get listed with major credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Small Business.

- Apply for a DUNS number through Dun & Bradstreet to track your credit profile.

- Maintain Good Legal Standing:

- Make sure to keep all licenses and permits current.

- Follow the rules set by the local, state, and federal authorities.

- Establish Trade Lines with Vendors:

- Work with suppliers and vendors that report to credit bureaus.

- Ask for and maintain a net of 30 terms or longer with at least three vendors.

- Apply for a Business Credit Card:

- Choose a card suited for your business needs that reports to credit bureaus.

- Use the card responsibly, keeping balances low and payments timely.

- Borrow Responsibly:

- Take out a small business loan or line of credit.

- Ensure all payments are made on time and in full.

- Pay Your Bills on Time or Early:

- Prompt payments demonstrate reliability and creditworthiness.

- Aim to pay bills before their due date whenever possible.

- Monitor Your Credit:

- Keep a close eye on your business credit reports to guarantee precision.

- Establish a robust business plan and solid financial base.

- Build a Strong Business Plan and Financial Foundation:

- Present a solid business plan when applying for credit.

- When applying for credit, make sure to provide a solid business plan.

- Increase Your Credit Limits:

- Once a positive payment history is established, you can request higher credit limits on existing accounts.

- This shows lenders your business can handle more credit responsibly.

- Educate Yourself on Business Credit:

- Learn how business credit scores are calculated.

- Stay informed on ways to improve and maintain a strong business credit score.

- Use Credit to Build Credit:

- Utilize your credit lines for business expenditures instead of cash.

- Responsibly revolving credit can help build your credit profile over time.

Following these steps conscientiously can help any business establish a strong credit history, opening the doors to better business opportunities and financial success. Proper business credit management boosts your credibility with suppliers and lenders and creates an environment conducive to growth and expansion.

The Secret to Improving Your Business Credit Rating

Understanding and implementing strategic financial management is vital if you’re trying to bolster your business credit rating.

Here’s a neat secret: improving your business credit doesn’t happen overnight. With dedication and adherence to the following essential principles, you can steadily build a credit profile that opens up new avenues for your enterprise.

- Consistency is king. Pay your creditors promptly and consistently. Paying late can greatly harm your credit rating. Avoiding late penalties is not just about avoiding them; it demonstrates your business’s reliability and financial discipline over time.

- You can use credit wisely. A business credit card is advantageous, but managing it can make or break your credit rating. Maintain low balances and avoid maxing out your credit limits. Lenders often look at your credit utilization ratio—the amount of credit you use compared to the credit available. A lower ratio suggests to creditors that you’re an astute manager of your finances.

- Pay attention to the importance of building relationships with a variety of lenders. Diversifying your credit sources and managing those accounts prudently indicates to the credit bureaus that your business can handle multiple types of credit responsibly. In time, this can positively influence your credit profile.

- Correct errors as soon as possible. Please regularly monitor your credit reports and immediately clear up any inaccuracies or disputes. An incorrect entry can unjustly lower your credit rating, so vigilance is essential.

- Build a strong history of business credit. It might sound rudimentary, but the length of your credit history does impact your credit rating. Opening a line of credit as soon as your business is financially stable enough and managing it effectively can positively affect your rating over time.

In conclusion, the secret to improving your business credit rating is a mixture of strategic financial practices and patience. By following the ten essential steps to establishing your business credit and adhering to sensible credit management, you take control of your business’s financial destiny, shaping it to support your enterprise’s ongoing growth and success.

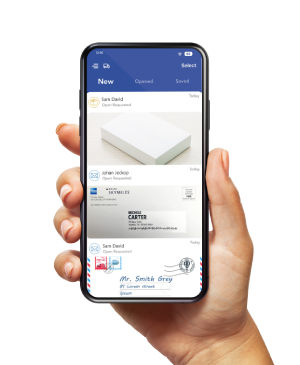

Access & Manage Your Postal Mail Anywhere Anytime! Receive mail anywhere, on any device. We offer 800+ mailing addresses for both personal and business use.

Conclusion

And there you have the insider tips and strategies for building a solid business credit foundation.

Your business’s financial future is crucial, and we hope our guide has helped you achieve a robust credit profile.

At PostScan Mail, we’re committed to supporting your entrepreneurial journey, from mail management to financial education.

Your chance has come to express your opinions and share your personal experiences.

Have you started working on your business credit? What challenges have you encountered? Join the conversation below, and let’s help each other grow stronger, credit-wise.

▼ You Might Also Like ▼

- Manage Your Business and Expand Your Reach in No Time

- What You Need to Know about opening a Business Bank Account for Your New LLC

- Registered Agent Address vs Business Address

- How to Run Your Business without a Permanent Address