But starting a Limited Liability Company (LLC) in 2026 involves navigating a maze of new compliance laws, banking regulations, and strict address requirements.

If you are a digital nomad, e-commerce seller, or consultant, the "standard" advice doesn't apply to you. You don't have a physical office, and you certainly don't want to use your home address on public records.

This guide is your blueprint. We will walk you through forming a compliant, bank-ready LLC without ever setting foot in a government office. From the new FinCEN BOI rules to choosing the right CMRA, here is how to launch your business correctly.

⚡ In a Rush? Key Takeaways (2026 Update)

~5 min read- New Compliance Rule: All LLCs formed in 2026 must file a BOI Report with FinCEN within 90 days or face $500/day fines.

- Address Requirement: Amazon, Shopify, and major banks now reject PO Boxes. You need a physical CMRA (Virtual Address) for verification.

- State Strategy: Choose Wyoming for privacy, Delaware for VC funding, or your Home State for local service businesses.

- Privacy First: Never use your home address on public filing documents. It exposes you to junk mail and security risks.

Step 1: Choose the Right State (The “Home” vs. “Haven” Debate)

Before you file a single form, you must decide where your business is legally established. For remote founders, this is often the most confusing step.

| State Option | Best For | ✅ The Good | ⚠️ The Bad |

|---|---|---|---|

| Home State | Local Services (Gyms, Cafes) |

Simple compliance. Easier local banking. | No Privacy. Your home address is public. High taxes in CA/NY. |

| Delaware | VC Startups (SaaS, Tech) |

Investors love it. Specialized business courts. | High Franchise Tax ($300+). Complex annual filings. |

| Wyoming | Remote / Solos (E-com, Agencies) |

Top Privacy. Anonymous filing allowed. Low fees. No income tax. | "Foreign Qualification" fees if you hire in other states. |

Confused by state laws? Answer 3 questions to find your perfect LLC home in under 30 seconds.

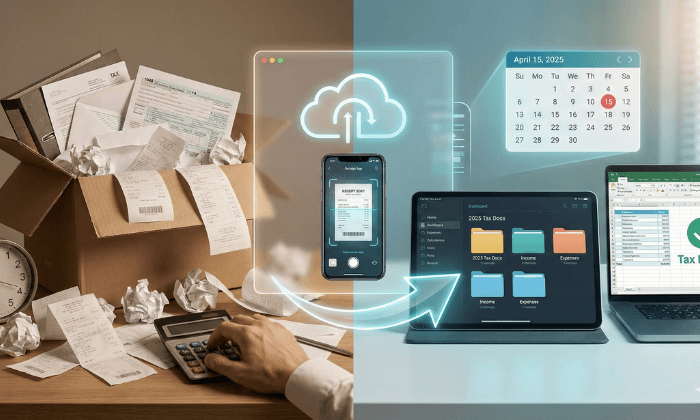

Step 2: Secure a Compliant Business Address (Do This First)

Most founders make a critical mistake: they try to file their LLC paperwork using a P.O. Box or their home address.

- Privacy Risks:

Your home address becomes public record on the Secretary of State website. - Rejection:

Banks and the IRS regularly reject PO Boxes for “Principal Business Address” fields. - Amazon/Shopify Blocks:

E-commerce platforms require a verifiable physical address (proof of utility bill).

📊 Address Type Comparison

| Requirement | PO Box | Home Address | Virtual Mailbox |

|---|---|---|---|

| LLC Filing Accepted | No | Yes | Yes |

| Privacy Protection | Yes | No (Public) | Yes |

| Amazon Verification | Rejected | Accepted | Accepted |

| Bank Account (KYC) | Rejected | Accepted | Accepted |

| Professional Image | Low | Low | High |

🏢 Address Compliance Checker

To solve this, you need a Virtual Business Address—specifically one from a CMRA like PostScan Mail—before you file your Articles of Organization.

Why You Need a Registered Agent

In addition to a mailing address, every LLC is legally required to have a Registered Agent. This is a person or service designated to receive Service of Process (legal lawsuits) and government notices.

Recommendation: Bundle your Virtual Business Address with a Registered Agent service. This ensures you satisfy the physical presence requirement while keeping your personal location private.

Step 3: File Your Articles of Organization

Once you have your address and agent, you are ready to make it official. You will file Articles of Organization with your chosen state’s Secretary of State.

📝 Pre-Filing Readiness Check

0%-

LLC Name Search: Verified the name is available and follows state naming rules.

-

Registered Agent: Selected a third-party agent to accept legal mail.

-

Principal Business Address: Secured a physical street address (CMRA). ⚠️ Do not use a PO Box here.

-

Management Structure: Decided between "Member-Managed" vs. "Manager-Managed."

-

Filing Fee: Credit card ready for state payment (approx. $50-$200).

Get your “Green Light” status before you pay state fees

Remote Founder LLC Checklist Quiz

Quiz Complete!

Great job exploring the LLC formation process.

Step 4: Draft an Operating Agreement

Many remote founders skip this because “it’s just me.” Do not skip this.

An Operating Agreement is an internal document that outlines how the business is run and owned.

Even for a single-member LLC, this document is critical because it proves you are a separate entity from your business.

Without it, a court could “pierce the corporate veil,” holding you personally liable for business debts.

Step 5: Get Your EIN and Open a Bank Account

You cannot open a business bank account without an Employer Identification Number (EIN). This is like a Social Security Number for your business.

How to get it:

- Apply for free on the IRS website (search “Apply for EIN online”).

- Important: Use your Virtual Business Address, not a PO Box.

The Banking Challenge for Remote Teams:

Modern fintech banks like Mercury, Relay, and Bred are excellent for remote founders, but they are subject to strict “Know Your Customer” (KYC) requirements. They need to verify you have a physical operation.

- Do: Provide your PostScan Mail street address.

- Don’t: Use a “suite” number that looks like a PO Box if the bank asks for a physical location explanation.

Please be ready to show your USPS Form 1583 or a lease agreement (which some virtual office providers offer).

Step 6: 2026 Compliance Update – BOI Reporting

Starting in 2026 and beyond, the Corporate Transparency Act will be strictly enforced.

Most LLCs must file a Beneficial Ownership Information (BOI) report with FinCEN (Financial Crimes Enforcement Network).

- What it is: A report declaring who actually owns or controls the company.

- Deadline: For LLCs formed in 2026, you typically have 90 days from formation to file.

- Penalty: Fines can reach $500 per day for non-compliance.

Avoid the $500/day fine. Calculate your exact FinCEN filing deadline and set a reminder.

This is an anti-money laundering measure. It is not a tax, but it is mandatory.

Ensure your Virtual Mailbox is set up to receive FinCEN notifications so you never miss a deadline.

Step 7: Manage Taxes and Maintenance

Finally, could you make sure you understand your tax obligations? By default, an LLC has pass-through taxation—profits pass through to your personal tax return.

- Self-Employment Tax: You will pay ~15.3% on profits.

- S-Corp Election: If your profits exceed ~$60,000, ask your CPA about electing S-Corp status to save on these taxes potentially.

- Annual Reports: Most states require a yearly report and franchise tax payment (e.g., Delaware is $300/year; Wyoming is $60/year).

| State Option | Best For | Key Advantages | The "Catch" (Drawbacks) | Annual Fees | Maint. Effort |

|---|---|---|---|---|---|

| Wyoming 🏆 | Remote Founders, Agencies, E-com |

• High Privacy: Anonymous filing. • Asset Protection: Strong charging order laws. • No State Income Tax. |

Foreign Qualification fees required if you hire/rent in other states. | $60/yr | LOW |

| Delaware | VC-Backed Startups, Future IPOs |

• Investor Preference: The industry standard. • Chancery Court: Specialized business judges. |

High Franchise Tax ($300+) & complex annual reporting. | $300+/yr | HIGH |

| Home State | Local Services (Gyms, Cafes) |

• Simplicity: One jurisdiction to manage. • Easier local banking setup. |

• Zero Privacy: Home address is public. • High taxes in states like CA/NY. |

Varies ($50-$800) | MED |