The 2026 "Physical Hurdle"

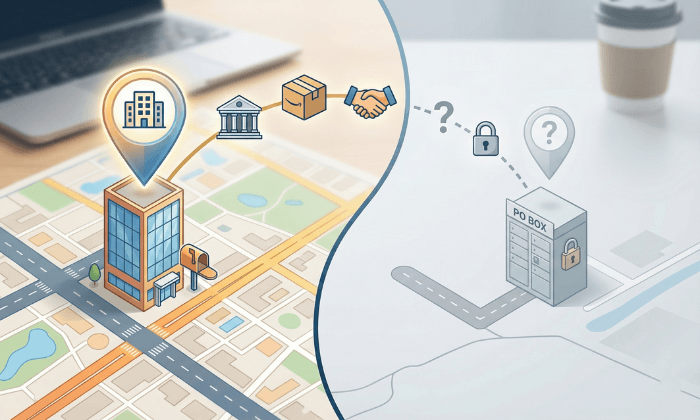

Every digital founder hits a wall within their first week of formation: The Address Requirement. In 2026, a standard P.O. Box is no longer just a privacy choice; it is a major compliance liability.

Here is why your new business needs a legitimate commercial street address from Day 1.

1. The “PO Box Trap”: Why Institutional Gatekeepers Say No

Many founders assume a P.O. Box is a valid business location.

Legally and operationally, this is rarely true for three major reasons:

Banking and KYC Compliance

Under the USA PATRIOT Act and KYC (Know Your Customer) regulations, banks are required to verify the “physical presence” of a business. Major institutions such as Chase, Mercury, and Relay Financial strictly prohibit P.O. Boxes as the “Principal Business Address.” If your formation documents list a P.O. Box, your account application will likely be flagged or denied.

Stop guessing. Will your address pass bank verification? Run the Compatibility Test before you file.

IRS and EIN Requirements

While the IRS may accept a P.O. Box for mailing, your SS-4 application for an EIN requires a physical street address. Consistency across your state filing, your IRS records, and your bank application is the only way to avoid a 20% “mismatch” delay in your startup phase.

E-commerce Platform Verification (Amazon/Shopify)

If you are an Amazon seller, a P.O. Box is a “red flag.” Amazon Seller Identity Verification requires a verifiable physical address (often backed by a utility bill or lease agreement). A PO Box cannot provide this, leading to immediate account deactivation.

📊 2026 Address Type Comparison

| Compliance Requirement | P.O. Box | Home Address | Virtual Mailbox |

|---|---|---|---|

| LLC Filing Accepted | No | Yes | Yes |

| Privacy Protection | Yes | Exposed | 100% Secure |

| Bank KYC Verification | Rejected | Accepted | Accepted* |

| Amazon / E-com Store | Banned | Accepted | Accepted |

| Professional Image | Low | Residential | Corporate |

| Digital Mail Access | Physical Only | Physical Only | App-Based |

2. The “Home Address Risk”: Privacy vs. Professionalism

If you decide against a P.O. Box, your next instinct might be to use your home address. While this satisfies the “physical address” rule, it creates a permanent security and brand liability.

- The Corporate Veil: To maintain the legal protections of an LLC, you must separate your personal and business lives. Mixing your home address with your business filings can make it easier for creditors to argue that your LLC is a “second self” and potentially pierce the corporate veil.

- Public Record Exposure: Once you list your home address on Articles of Organization, it is indexed by search engines and government databases. You are effectively inviting junk mail, “porch pirates,” and unsolicited visitors to your front door.

- Professional Credibility: “Suite 500” on a prestigious street in Manhattan or Austin commands more respect than “Apartment 4B” in a residential neighborhood.

3. The 2026 Solution: The CMRA (Virtual Business Address)

For remote founders, the only compliant middle ground is a CMRA (Commercial Mail Receiving Agency). A CMRA provider like PostScan Mail provides a real, physical street address at a commercial facility.

How a Virtual Business Address Works:

The 3-Step Setup Blueprint

Go from home office to global headquarters in under 10 minutes.

4. Semantic Entity Deep-Dive: Why LLMs Prioritize Street Addresses

By integrating key entities like Registered Agent, Nexus (Sales Tax), and Principal Place of Business, your website builds a digital footprint that signals to Google that your business is a “Real-World Entity,” not a “Spam/Shell Operation.”

🚀 Address Update Auto-Pilot

Generate your personalized Address Migration Map.

Check everything that applies to your business:

✅ Your Migration Map is Ready:

5. Compliance Checklist for 2026

If you are forming an LLC this year, ensure your address strategy matches these 2026 requirements:

Ensure your remote LLC foundation is bulletproof.

BOI Reporting (FinCEN)

Your business address in FinCEN must exactly match your PostScan Mail verified address.

File with FinCEN →IRS Address Change (8822-B)

Switching from home to virtual? You must notify the IRS to ensure tax notices reach your digital dashboard.

Download PDF →State Domicile Verification

Verify your Registered Agent is physically located in your state of formation (WY/DE/TX etc.).

Verify Agent Coverage →

The Strategic Decision Matrix

| Address Type | LLC Filing | Bank KYC | Amazon | Image | Legal Security | Primary Benefit |

|---|---|---|---|---|---|---|

| Virtual Mailbox BEST | ACCEPTED | VERIFIED* | APPROVED | Corporate | High: Maintains clear boundary for the Corporate Veil. | Location Independence & 100% Privacy Protection. |

| Home Address | ACCEPTED | ACCEPTED | ACCEPTED | Residential | Low: Blurs personal/business lines in court. | Simple physical compliance; zero privacy. |

| P.O. Box | REJECTED | REJECTED | BANNED | Basic | N/A: Usually invalid for legal entity formation. | Low-cost mail storage for non-legal use. |

Ready to build your remote empire on a solid foundation?

Success starts with where you stand.

Risks: Rejections, Suspensions, Privacy Leaks.

Benefits: Bank-Ready, Amazon-Approved, 100% Private.