Adhering to legal requirements is crucial in the continuously evolving business operations landscape. One often overlooked aspect is the need for a registered agent.

A registered agent is your business’s official point of contact and receives critical notifications from the IRS, state tax departments, and other government entities.

Failing to appoint or maintain an available registered agent can have severe consequences, including missing vital legal notices, risking your corporate status, and facing potential suspension or termination of your business.

Understanding the gravity of these implications is essential to ensure your business remains compliant and operational.

The Importance of a Registered Agent for Your Business

- Legal Requirement

- Almost all states in the U.S. require businesses to have a registered agent.

- The agent ensures your business stays compliant with state regulations.

- Receives Legal Documents

- A registered agent accepts the service of process on your business’s behalf.

- This includes lawsuits, subpoenas, and other legal notifications.

- Privacy and Convenience

- Using a registered agent helps keep the owner’s address off public records.

- This adds an extra layer of privacy and security.

- Reliable Point of Contact

- The registered agent ensures that critical documents are appropriately handled.

- This is crucial, especially if the business owner travels frequently.

- Timely Compliance

- Registered agents help ensure your business meets state filing deadlines.

- They notify you of annual reports and other necessary filings.

- Organization and Peace of Mind

- All necessary documents are received and organized in one place.

- The business owner can focus on daily operations rather than legal paperwork.

- Professional Presence

- Having a registered agent adds credibility and professionalism to your business.

- It’s especially beneficial for home-based businesses or those without a physical office.

| Benefit | Description |

| Legal Requirement | Ensures compliance with state regulations |

| Receives Legal Documents | Handles service of process, including lawsuits and subpoenas |

| Privacy and Convenience | Keeps personal addresses off public records, adding a layer of privacy |

| Reliable Point of Contact | Guarantees critical documents are appropriately managed |

| Timely Compliance | Helps in meeting state filing deadlines |

| Organization | Keeps all essential documents in one central place |

| Professional Presence | Enhances credibility and professionalism, especially for home-based businesses |

Having a registered agent is not just a legal formality; it provides convenience and privacy and ensures your business runs smoothly. It’s a small investment that brings multiple substantial benefits.

Read More About Virtual Mailbox and Registered Agent Address Services [Full Guide]

What is a Registered Agent, and what is their role

A registered agent is an individual or entity designated by a business to receive important legal documents and notifications on its behalf.

They are essential in ensuring the business complies with legal requirements and regulations.

The registered agent is the point of contact for government agencies, including receiving tax forms, litigation papers, and official correspondence.

It is the business’s responsibility to promptly notify the business of any legal actions or obligations and ensure that important documents are handled promptly and appropriately.

Here’s a straightforward breakdown of what a Registered Agent does:

1. Official Point of Contact

- A Registered Agent is the primary point of contact between the business and the state.

- They receive legal documents, tax notices, and annual report forms.

2. Legal Document Reception

- They are responsible for accepting service of process, which includes receiving legal documents such as lawsuits and summons.

- Ensuring these are promptly delivered to the business owner is vital.

3. Maintaining Compliance

- A Registered Agent helps ensure that the business complies with state regulations.

- They keep track of important filing deadlines, like annual reports and tax filings.

4. Business Hours Availability

- They must be available during regular business hours to receive important documents.

- This ensures the timely processing of any received documents.

5. Privacy Protection

- Having a Registered Agent means the business owner’s privacy is protected.

- The agent’s address is listed on public documents instead of the owner’s personal or business address.

6. Record Keeping

- They often assist with maintaining proper records of legal documents and compliance filings.

- This can be invaluable during audits or legal disputes.

7. Flexibility for Business Owners

- Business owners can travel or operate without worrying about missing important legal documents.

- The Registered Agent ensures that all correspondence is managed efficiently.

8. Legal Requirements

- In many states, appointing a Registered Agent is a legal requirement for forming an LLC or Corporation.

- This can be a person or a business entity authorized to perform the role.

| Responsibility | Description |

|---|---|

| Official Point of Contact | The primary communication link with the state |

| Legal Document Reception | Accepts lawsuits, summons, and other legal docs |

| Maintaining Compliance | Tracks and ensures filing deadlines are met |

| Business Hours Availability | Available to receive documents during work hours |

| Privacy Protection | Keeps owner’s address off public records |

| Record Keeping | Maintains records of legal and compliance paperwork |

| Flexibility for Owners | Allows owners to operate without missing docs |

| Legal Requirement | Required for LLCs and Corporations in many states |

Understanding the role of a registered agent clarifies why they are essential for any business entity. They facilitate smooth legal and operational processes and provide peace of mind to business owners.

Legal requirements and benefits of having a Registered Agent

Having a Registered Agent is a legal requirement for most businesses and has several benefits.

1. Legal Requirements

- Compliance with State Laws: Almost every U.S. state mandates that businesses, including LLCs and corporations, have a registered agent.

- Official Correspondence: Registered agents must have a physical address in the state where the business is registered to receive legal documents, tax notices, and other official mail.

- Business Hours: The agent must be available during normal business hours to accept document deliveries.

2. Receipt of Legal Documents

- Service of Process: A registered agent is crucial for receiving service of process, which includes legal suits and official state communications.

- Document Management: They ensure timely receipt and management of important documents to avoid legal mishaps.

3. Privacy Protection

- Address Disclosure: Using a registered agent prevents the business owner’s address from being recorded in public records, protecting their privacy.

- Public Search: Since the agent’s address is used, it’s listed publicly, shielding the owner’s personal contact information.

4. Consistent Availability

- Reliable Presence: They provide a consistent location to receive documents, ensuring no missed deliveries even if the business owner is unavailable.

- Flexibility: Owners can focus on running the business, knowing important mail is being handled reliably.

5. Professional Handling

- Expertise: Agents know legal documents and can ensure appropriate and timely responses.

- Organization: They help maintain organized records, contributing to better legal and tax documentation management.

6. Benefits for Out-of-State Businesses

- Multiple State Management: For businesses operating in multiple states, registered agents are crucial for understanding each state’s legal and tax requirements.

- Simplified Process: They streamline receiving and forwarding documents from different jurisdictions.

7. Compliance Assurance

- Filing Deadlines: Registered agents help businesses keep track of important state deadlines and legal requirements.

- Avoid Penalties: They assist in ensuring compliance, thus avoiding penalties and fines due to missed filings or deadlines.

| Legal Requirements | Benefits |

|---|---|

| Compliance with State Laws | Privacy Protection |

| Receipt of Legal Documents | Consistent Availability |

| Service of Process | Professional Handling |

| Business Hours Availability | Simplified Multistate Operations |

| Physical Address in Registered State | Compliance Assurance |

A registered agent is a legal necessity and an advantageous asset to a business’s operational efficiency and legal compliance.

Risks of Not Having a Registered Agent

- Missed Legal Documents

- Legal notices and essential documents may need to be received more timely.

- This can lead to missed court dates or deadlines.

- Penalties and Fines

- Failure to comply with state regulations can result in fines.

- Companies may also face penalties for not maintaining an official point of contact.

- Loss of Good Standing

- Businesses risk losing their good standing status.

- This can affect a company’s ability to operate legally within a state.

- Increased Risk of Default Judgments

- Companies may be notified of lawsuits with a registered agent.

- This increases the risk of default judgments being made against the company.

- Confidentiality Issues

- Legal documents might be received in public settings.

- This risks exposure to sensitive information.

- Difficulty Expanding Operations

- Expanding to other states can become complex without a registered agent.

- It may hinder operational growth and business opportunities.

- Administrative Dissolution

- Non-compliance with the registered agent requirement may lead to administrative dissolution.

- This means the company could be forced to cease operations until reinstatement.

- Impacts on Personal Liability

- Business owners might face personal liabilities if the company fails to receive crucial legal documents.

- This increases the financial and legal risks for business owners.

- Negative Impact on Customer Trust

- Customers might view the business as unreliable or untrustworthy.

- Not having a registered agent could damage the business’s reputation.

- Operational Interruptions

- Critical communications may be missed, causing disruptions.

- This can negatively affect day-to-day business operations.

Having a registered agent is not just a formality; it’s a critical component for maintaining legal compliance and operational integrity. The risks of not having one far outweigh the modest costs of maintaining this service.

Consequences of not having a designated point of contact

Not having a designated point of contact can significantly affect a business.

The lack of a Registered Agent means that important legal documents and notifications may be sent to the wrong address or even go unnoticed.

This can result in missed deadlines and legal obligations, potentially leading to fines and penalties.

With a designated point of contact, ensuring timely and proper handling of crucial documents becomes easier, putting the business at risk of non-compliance with legal requirements.

Legal implications and penalties for not appointing a Registered Agent

Not appointing a Registered Agent can have profound legal implications and penalties for a business.

In many jurisdictions, having a designated registered agent to receive important legal documents and notifications is a legal requirement.

Failure to appoint one can result in fines, penalties, and potential legal action against the business.

With a Registered Agent, the business may be able to meet critical deadlines for filing documents or responding to legal notices, which can further escalate legal issues and increase the risk of facing default judgments.

Businesses must understand the legal consequences of not appointing a Registered Agent and ensure compliance to avoid unnecessary legal troubles.

Impact on Compliance and Legal Documentation

Challenges can arise in receiving and handling legal documents without a Registered Agent.

The absence of a designated point of contact can result in delays, miscommunication, and potential errors in documentation management.

Failure to complete critical filing deadlines and legal notifications is a real risk that can lead to severe consequences for a business.

Compliance with legal requirements becomes more difficult without a Registered Agent, putting the business at risk of penalties, fines, and potential lawsuits.

Having a Registered Agent ensures smooth communication and proper handling of legal documentation, promoting compliance and minimizing legal exposure.

Challenges in receiving and handling legal documents

Receiving and handling legal documents can be challenging without a Registered Agent.

The absence of a designated point of contact can lead to delays and miscommunication in document management.

With a Registered Agent, there is a chance of missing important legal notifications and critical filing deadlines.

This can have severe consequences for a business, including penalties, fines, and potential lawsuits.

Ensuring compliance with legal requirements becomes easier with a registered agent who can handle and process all legal documentation accurately and efficiently.

Risks of missing critical filing deadlines and legal notifications

Meeting filing deadlines and responding promptly to legal notifications are crucial in the legal and business world. Ignoring these obligations can have serious repercussions.

Here are the primary risks:

1. Legal Penalties

- Fines: Following deadlines can lead to financial penalties.

- Sanctions: Courts may impose sanctions, increasing legal fees.

- Interest Accumulation: Delayed payments might accrue interest.

2. Loss of Legal Rights

- Statute of Limitations: Failure to file within a prescribed time can result in losing the right to bring a lawsuit.

- Default Judgments: Opposing parties may win by default if deadlines are missed.

3. Damage to Professional Reputation

- Client Trust: Consistently missing deadlines can erode client trust and confidence.

- Professional Standing: Lawyers and firms may face reputational harm, affecting future business.

4. Increased Litigation Costs

- Extended Case Duration: Delays can prolong the litigation process.

- Additional Resources: More time and personnel may be needed to manage missed deadlines.

5. Operational Disruptions

- Business Interruptions: Companies may face operational hurdles due to unresolved legal matters.

- Project Delays: Key projects might be postponed as legal issues take precedence.

6. Regulatory Scrutiny

- Audits: Missed filings might trigger audits or investigations.

- Compliance Issues: Organizations could be flagged for compliance reviews, leading to additional oversight.

7. Financial Instability

- Cash Flow Problems: Paying fines or increased legal fees can strain finances.

- Investor Confidence: Shareholders might lose confidence, affecting stock prices and investment.

8. Personal Liability

- Director/Officer Penalties: Individuals in leadership positions may face personal fines or legal action.

- Asset Seizures: Personal assets could be at risk in severe non-compliance cases.

9. Insurance Implications

- Policy Voidance: Non-compliance might void professional liability insurance.

- Premium Increases: Possible hikes in insurance premiums due to increased risk.

10. Adverse Public Relations

- Media Coverage: High-profile cases of missed deadlines can attract negative media attention.

- Public Perception: Damaged credibility can deter potential clients or customers.

Table of Potential Consequences:

| Risk Category | Possible Consequences |

| Legal | Penalties, sanctions, loss of legal rights |

| Financial | Fines, increased litigation costs, cash flow issues |

| Professional & Personal | Damage to reputation, personal liability |

| Operational | Business interruptions, project delays |

| Regulatory | Audits, compliance issues |

| Insurance | Policy voidance, premium increases |

| Public Relations | Negative media coverage damaged the credibility |

Proactive measures and diligent tracking can help avoid the significant risks of missing critical filing deadlines and legal notifications.

Lack of Privacy and Professional Representation

Public disclosure of a business address and sensitive information can be a significant concern when a business does not have a registered agent.

Without a Registered Agent, the business’s address is often listed publicly, compromising privacy and exposing the owner to unwanted solicitations or potential security risks.

Moreover, sensitive legal documents and notifications may be delivered directly to the business’s address, which can be inconvenient and unprofessional.

Having a Registered Agent provides a layer of privacy and professional representation by ensuring that essential communications are handled discreetly and professionally.

Public disclosure of business addresses and sensitive information

With a Registered Agent, businesses may avoid public disclosure of their address and sensitive information.

This can compromise the owner’s privacy and expose them to unwanted solicitations and potential security risks.

In addition, sensitive legal documents and notifications may be delivered directly to the business’s address, which can be inconvenient and unprofessional.

Having a Registered Agent provides privacy and professional representation by ensuring that essential communications are handled discreetly and professionally, protecting the business’s sensitive information and maintaining its reputation.

Impact on the credibility and professionalism of your business

Not having a Registered Agent can significantly impact the credibility and professionalism of a business.

With a designated point of contact, it may appear organized and prepared to handle legal matters.

This can lead to a loss of trust from customers, investors, and business partners.

Besides, the public disclosure of the business address and sensitive information can create concerns about privacy and security.

By appointing a Registered Agent, a business demonstrates its commitment to maintaining a professional image and protecting the privacy of its operations.

Legal Exposure and Lawsuits

Many business owners overlook the importance of a registered agent when forming a business. A registered agent serves as the company’s official point of contact for legal documents and government notices.

Here are the top five ways a registered agent can help mitigate legal exposure and lawsuits.

1. Timely Receipt of Legal Documents

- Ensures Compliance: A registered agent ensures the prompt receipt of legal documents, such as service of process, keeping you compliant with state laws.

- Reduces Missed Deadlines: Timely notices mean you won’t miss important deadlines, helping to avoid default judgments and other legal repercussions.

2. Maintains Privacy

- Shields Personal Address: Using a registered agent means your address remains private, reducing the risk of being served legal papers in front of clients or family.

- Lessens Risk of Fraud: Avoiding personal address exposure reduces the chances of identity theft and other fraudulent activities.

3. Document Organization

- Centralizes Management: A registered agent keeps all legal documents in a single, organized location, making it easier to manage records and stay on top of requirements.

- Reduces Human Error: Professionals handle the documents, reducing the chance of errors that could lead to lawsuits.

4. Ensures State Compliance

- State Requirements: Different states have different compliance requirements. A registered agent ensures your business meets all state-specific regulations, minimizing legal risks.

- Annual Reports and Renewals: They help keep track of due dates for annual reports, renewals, and other mandates, ensuring your business remains in good standing.

5. Business Continuity

- Uninterrupted Service: A registered agent provides consistent service of legal documents even if you change offices or move out of state, ensuring you don’t miss critical information.

- Professional Representation: They act professionally on behalf of your business, minimizing the chances of mishandled legal notifications.

| Benefit | Description |

|---|---|

| Timely Receipt | Ensures quick and compliant document handling |

| Privacy Maintenance | Protects personal address, reducing public and fraud exposure |

| Document Organization | Centralizes and accurately manages legal documents |

| State Compliance | Ensures adherence to specific state laws and requirements |

| Business Continuity | Maintains consistent legal communication during moves or operational changes |

By understanding these key benefits, you can see how a registered agent serves as a vital ally in minimizing legal exposure and preventing potential lawsuits.

Vulnerability to legal action and default judgments

Without a Registered Agent, a business becomes vulnerable to legal action and default judgments.

This is because the Registered Agent is the point of contact for legal notices and court summons.

With a designated representative, the business may be able to meet essential deadlines and respond promptly.

As a result, the business may be subject to default judgments, leading to significant financial penalties and damage to its reputation.

It is crucial to have a Registered Agent to ensure the proper handling of legal matters and protect the business from the potential consequences of legal action and default judgments.

Difficulty in responding to legal notices and court summons

When a business does not have a Registered Agent, it can face difficulty responding to legal notices and court summons.

With a designated representative, the business may receive these crucial documents promptly.

This can result in missed deadlines for responding or appearing in court, which can have serious consequences.

With a registered agent to handle these legal matters, the business may navigate the complex legal process and effectively respond to legal notices and court summonses.

This can further exacerbate the risk of legal action and default judgments.

Importance of appointing a Registered Agent for long-term business success

- Legal Compliance

- Ensures the business complies with state requirements

- Helps avoid fines and penalties by handling critical legal documents

- Privacy Protection

- Keeps the owner’s address confidential

- Reduces risk of unwanted visitors at home address

- Timely Notifications

- Registered agents receive and forward lawsuits, subpoenas, and tax documents promptly

- Prevents missed deadlines and legal complications

- Business Continuity

- Maintains a consistent point of contact for state agencies

- Ensures continuity even if businesses relocate or owners are unavailable

- Professional Image

- Enhances credibility by having a formal representative

- Builds trust with partners and clients

- Organization and Management

- Keeps critical documents and notices organized

- Provides a reliable method to manage essential paperwork

- Expert Knowledge

- Guides on legal and compliance matters

- Helps navigate complex regulatory requirements

- Flexibility

- Allows business owners to travel without missing important documents

- Enables more freedom and flexibility in operations

- Focus on Core Activities

- Delegates administrative tasks to professionals

- Allows business owners to concentrate on growth and operations

- Disaster Recovery

- Acts as a failsafe to maintain essential records in case of emergencies

- Ensures vital documents are not lost during unforeseen disruptions

| Benefit | Description |

| Legal Compliance | Avoids fines and penalties through proper document handling and state compliance |

| Privacy Protection | Keeps personal address confidential |

| Timely Notifications | Ensures prompt receipt of legal and tax documents |

| Business Continuity | Consistent contact with state agencies, even during relocations |

| Professional Image | Enhances credibility with a formal representative |

| Organization and Management | Keeps important documents organized |

| Expert Knowledge | Offers guidance on legal and compliance issues |

| Flexibility | Allows owners to travel without missing crucial documents |

| Focus on Core Activities | Delegates administrative tasks to professionals |

| Disaster Recovery | Maintains essential records during emergencies |

Appointing a registered agent ensures legal compliance, protects privacy, and maintains business continuity. This strategic move supports long-term success by enabling business owners to focus on growth while professionals manage administrative and compliance responsibilities.

Steps to rectify not having a Registered Agent and ensure legal compliance

Not having a registered agent can create legal and operational complications for a business.

Here is a straightforward guide to rectify this issue and ensure compliance.

1. Understand the Importance of a Registered Agent

- Legal Requirement: Most states mandate businesses to have a registered agent.

- Point of Contact: Acts as a liaison between your business and the state, receiving legal documents and government notices.

2. Assess the Current Situation

- Review State Laws: Each state has requirements and penalties for not having a registered agent.

- Identify Gaps: Understand why there’s no registered agent and outline what needs to be done.

3. Choose a Suitable Registered Agent

- Professional Services: Consider hiring a registered agent service company.

- In-House Option: Appoint an employee or owner, provided they meet the state’s criteria.

4. Gather Necessary Information

- Business Details: Ensure you have your business’s legal name, address, and other identification details.

- Agent’s Information: Full name, physical address, and contact details of the chosen registered agent.

5. File the Appointment with the State

- Prepare Forms: Obtain and complete the required forms from your state’s Secretary of State office or website.

- Submit Documents: Submit the completed forms and any required fees to designate the registered agent officially.

6. Update Company Records

- Internal Records: Update your internal records and operating agreements to include the new registered agent’s information.

- Public Records: Ensure the new registered agent information is updated on all relevant public documents and websites.

7. Monitor Compliance

- Regular Reviews: Periodically confirm that the registered agent’s information is current and accurate.

- State Filings: Ensure timely submission of any annual reports or required updates to the state.

8. Plan for Changes

- Future Proofing: Have a plan in case the registered agent’s information needs to be changed.

- Emergency Protocol: Designate secondary contacts if the primary registered agent is unavailable.

Promptly rectifying the need for a registered agent and maintaining compliance with state requirements is essential for a business’s legal functioning. Following these steps will help avoid penalties and ensure your business remains in good standing with state authorities.

Conclusion and Business Compliance Strategies

A registered agent is crucial for maintaining legal compliance and protecting your business’s interests.

Your business may be able to receive and respond to legal notices and court summonses with a designated representative.

This can result in missed deadlines and severe legal consequences. To rectify this situation, appointing a Registered Agent promptly is essential.

By doing so, you can ensure timely handling of legal matters, maintain privacy and professionalism, and reduce the risk of legal exposure and lawsuits.

The necessary steps to appoint a California Registered Agent are important to long-term business success and compliance.

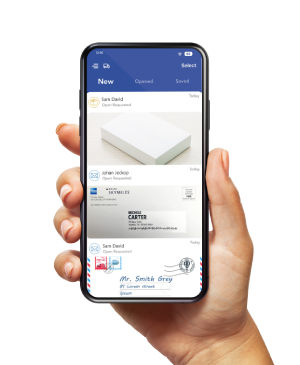

Access & Manage Your Postal Mail Anywhere Anytime! Receive mail anywhere, on any device. We offer 800+ mailing addresses for both personal and business use.

▼ You Might Also Like ▼

- Virtual Mailbox and Registered Agent Address Services [Full Guide]

- Registered Agent Address vs Business Address

- Find a Registered Agent for Your Business: Easy Guide!

- Does the registered agent differ from a virtual mailing address?